Bloomberg Businessweek’s latest “equality issue” has questioned whether the thousands of pages of U.S. tax code are — wait for it — “racist.” It’s as if the left isn’t even trying to make sense anymore.

Bloomberg Businessweek’s latest “equality issue” has questioned whether the thousands of pages of U.S. tax code are — wait for it — “racist.” It’s as if the left isn’t even trying to make sense anymore.

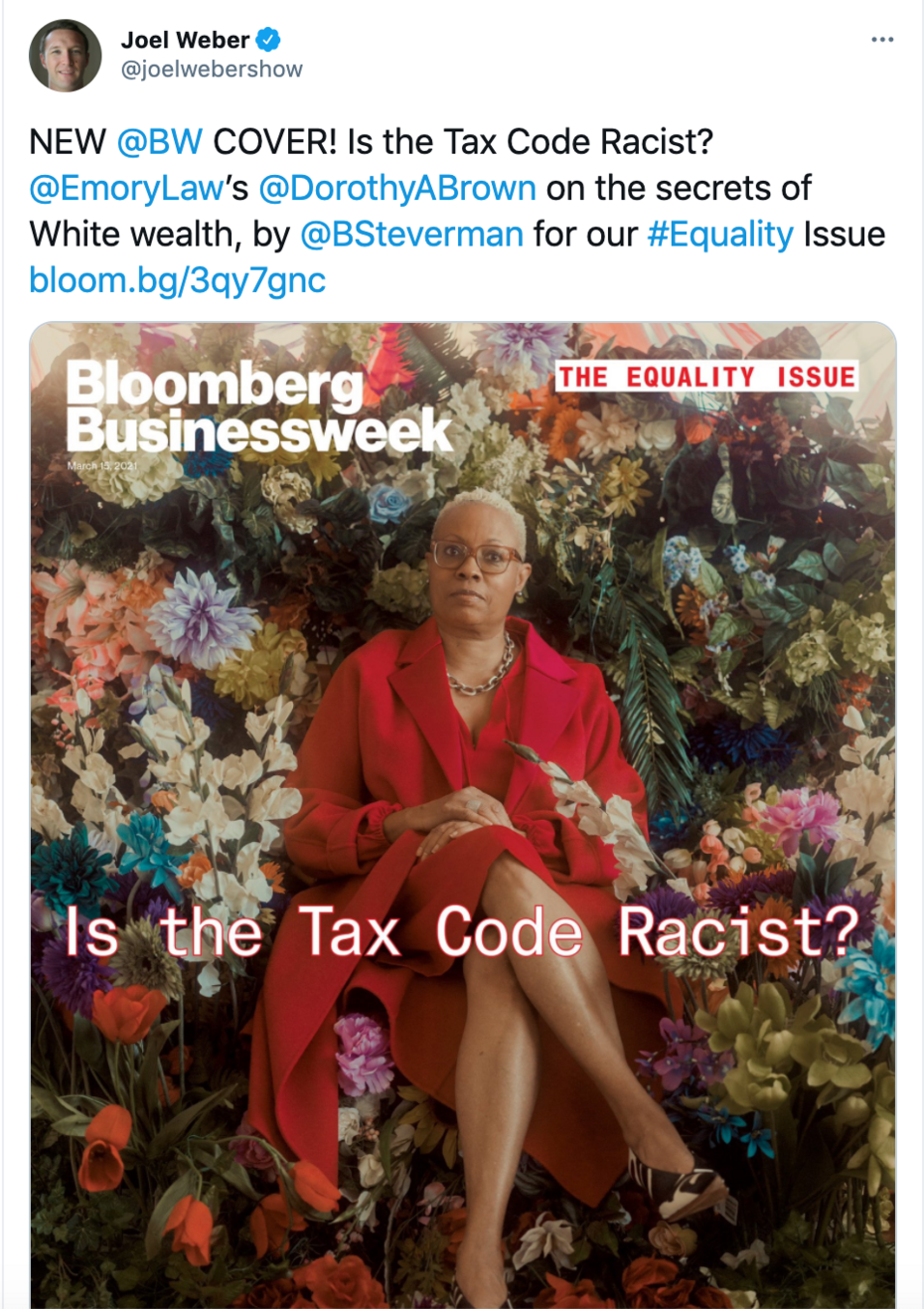

The cover of the new issue led with a picture of Emory University Law Professor Dorothy Brown — who made the argument that the tax code is racist. The picture was captioned with a leading question: “Is The Tax Code Racist?” The actual story headline was just as bad: “A Tax Code Optimized for White Wealth Leaves Black Americans Behind.”

The piece propagandized Brown’s history and bloviated how “As a teenager, Brown thought she’d found a way out—a loophole in American racism. Taking an accounting class, the self-described math geek discovered the U.S. tax code.” Of course, the article had nothing to do with simplifying the tax code for all Americans. On the contrary, the piece backed Brown’s apparent effort to make white people pay more taxes.

The article continued to push Brown’s thesis based on her radical upcoming book called “The Whiteness of Wealth”:

Brown spent a quarter century trying to prove the opposite [of the notion that the only color the tax law sees is 'green']: that although tax laws may appear to be colorblind, they still discriminate against Black Americans. Now the Asa Griggs Candler professor of law at Emory University, Brown is preparing to publish a book that’s the culmination of years of research, titled The Whiteness of Wealth: How the Tax System Impoverishes Black Americans—and How We Can Fix It.

Businessweek was giddy that President Joe Biden could take Brown’s research to a “new level.” “Just hours after being sworn in on Jan. 20, the president signed an executive order creating a cross-agency group with a mandate to address systemic racism in the U.S. government.” Brown’s reform plan would arbitrarily “strip the tax code of exemptions and deductions that steer advantages to White Americans. All income should be taxable, she says. No more exclusions for gifts, inheritances, or property sales,” Businessweek said.

Businessweek said Brown’s racially charged book comes at an “opportune time.” But the magazine appeared to undercut Brown’s arguments when it admitted that “the [Internal Revenue Service] doesn’t take race into account when it analyzes its giant trove of tax data.” To prove her arguments, said Businessweek, Brown “had to laboriously stitch together information from dozens of other sources to prove her book’s thesis.” The best evidence, according to Businessweek, was “the sheer size and persistence of the racial wealth gap.”

Businessweek said Brown’s racially charged book comes at an “opportune time.” But the magazine appeared to undercut Brown’s arguments when it admitted that “the [Internal Revenue Service] doesn’t take race into account when it analyzes its giant trove of tax data.” To prove her arguments, said Businessweek, Brown “had to laboriously stitch together information from dozens of other sources to prove her book’s thesis.” The best evidence, according to Businessweek, was “the sheer size and persistence of the racial wealth gap.”

Two CATO experts, Chris Edwards and Ryan Bourne, have already debunked the idea of using “wealth inequality” as a reliable measure for understanding the status of poor Americans. They wrote: “Measures of wealth inequality do not tell us anything about the well‐being of the poor, which is a more important focus for public policy than inequality. Poverty may fall as wealth inequality rises, such as when entrepreneurs build fortunes by generating economic growth.”

Edwards and Bourne continued: “[Wealth inequality] cannot be judged good or bad by itself because it may reflect either a growing economy that is lifting all boats or a shrinking economy caused by corruption.”

Conservatives are under attack. Contact Bloomberg Businessweek at contactus@bloombergsupport.com and demand it stop caving to woke culture and stop playing fiddle to critical race theory.