The world’s richest man and liberal Washington Post owner Jeff Bezos broke his silence to advocate for President Joe Biden’s plan to hike the corporate tax rate from 21 percent to 28 percent.

The world’s richest man and liberal Washington Post owner Jeff Bezos broke his silence to advocate for President Joe Biden’s plan to hike the corporate tax rate from 21 percent to 28 percent.

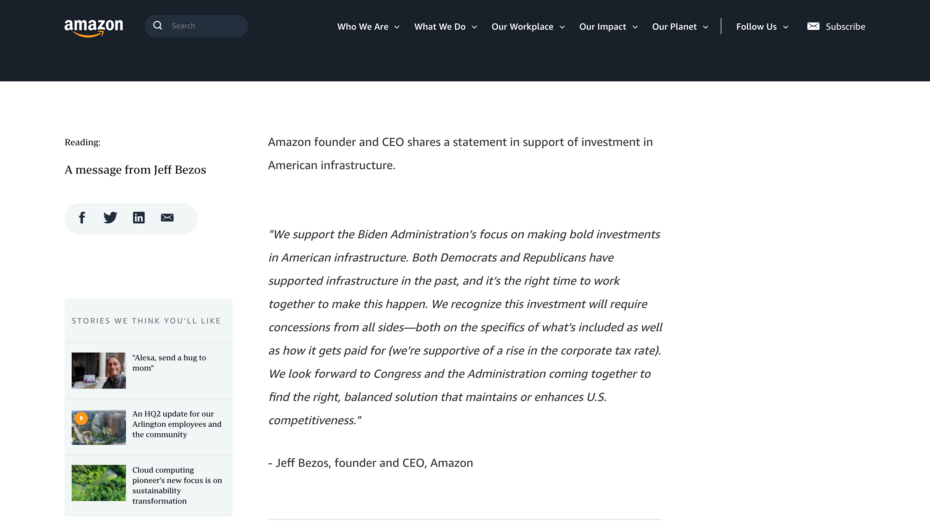

The Amazon CEO released a statement April 6 praising how “[w]e support the Biden Administration’s focus on making bold [multitrillion-dollar] investments in American infrastructure.” Bezos attempted to seem bipartisan, but then slipped a little note in parentheses that underscored his liberal political bent: “We recognize this investment will require concessions from all sides—both on the specifics of what’s included as well as how it gets paid for (we’re supportive of a rise in the corporate tax rate).” Bezos is supporting the same “corporate tax rate” that the Tax Foundation had tweeted March 17 was “the most harmful tax for economic growth.”

Bezos also touted one of the Biden administration’s Big Lies. He said he looked forward to a “balanced solution that maintains or enhances U.S. competitiveness." Given that the Tax Foundation said the tax hikes in Biden’s infrastructure plan “will raise the cost of production in the U.S., erode American competitiveness, and slow our economic recovery,” it is simply false that the Biden plan will enhance U.S. competitiveness.

Here’s a burning question: Now that Bezos has signaled favor for Biden’s plan, how can The Post report fairly on corporate tax hikes? One Post story published April 5 griped that “Dozens of America’s biggest businesses paid no federal income tax — again.” The story used its blaring headline to promote Biden’s call for a “higher corporate tax rate to fund his package of infrastructure investments, as well as a higher minimum tax on income earned by American companies overseas.”

Bezos’s statement could also prove a major “tax avoidance” argument mentioned by former President Ronald Reagan’s economic adviser Arthur Laffer in a recent Fox Business segment. Laffer pointed out how the rich could typically resort to using “evasion, avoidance, underground economy, tax shelters — all sorts of things — legal and illegal to get around the taxes. And that’s been true from time and memorial.” The fact that the world’s richest man has decided to support corporate tax hikes he could find a way to “get around” is ironic.

Laffer theorized that if the benefits under former President Donald Trump’s tax cuts are in fact reversed, “the rich aren’t just going to sit there and take it. They never do.”

Fox Business host and former National Economic Council director Larry Kudlow agreed with Laffer in the segment:

Not only are incentives being cut back, so there are barriers to work and investment on an after-tax reward basis, but people will avoid paying taxes. The revenue estimates will always be too high. The numbers coming in will be way, way lower.

Conservatives are under attack. Contact The Washington Post at 202-334-6000 and demand the newspaper disclose its owner’s support for Biden’s corporate tax hike proposal every time the paper reports on the administration’s infrastructure plan.